.png)

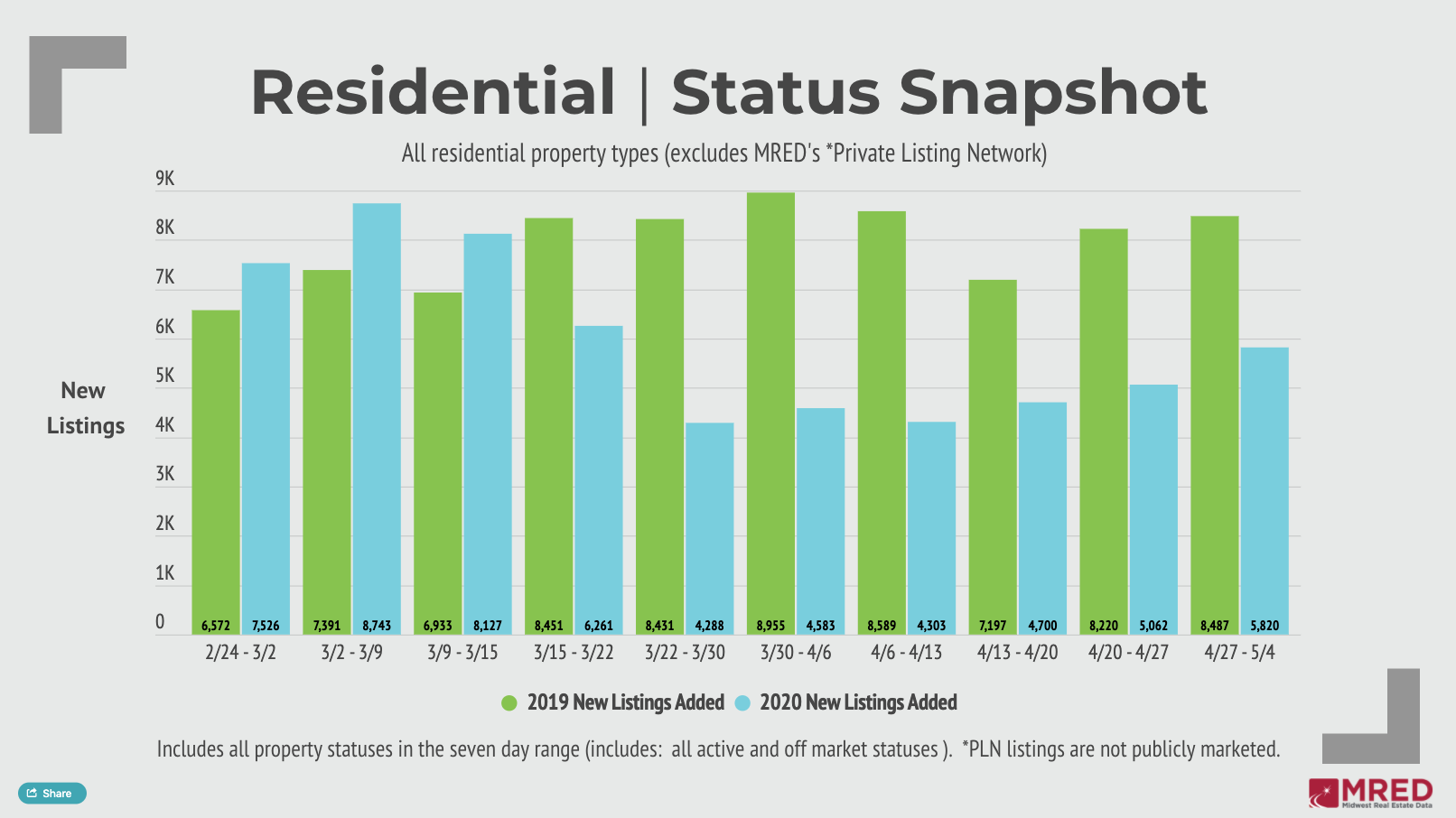

Ever since COVID-19 news hit the world, the real estate market met a significant crossroads: many people were questioning if it was a good time to sell, for safety, and what would happen to our still-strong prices. Data now backs up that we did, in fact, see a halt in the market. Especially towards the end of March, there was a drastic drop in newly listed properties - less than half of the amount listed that week last year (keep in mind, before the pandemic hit, 2020 numbers were exceeding 2019 numbers). So yes, the response was strong.

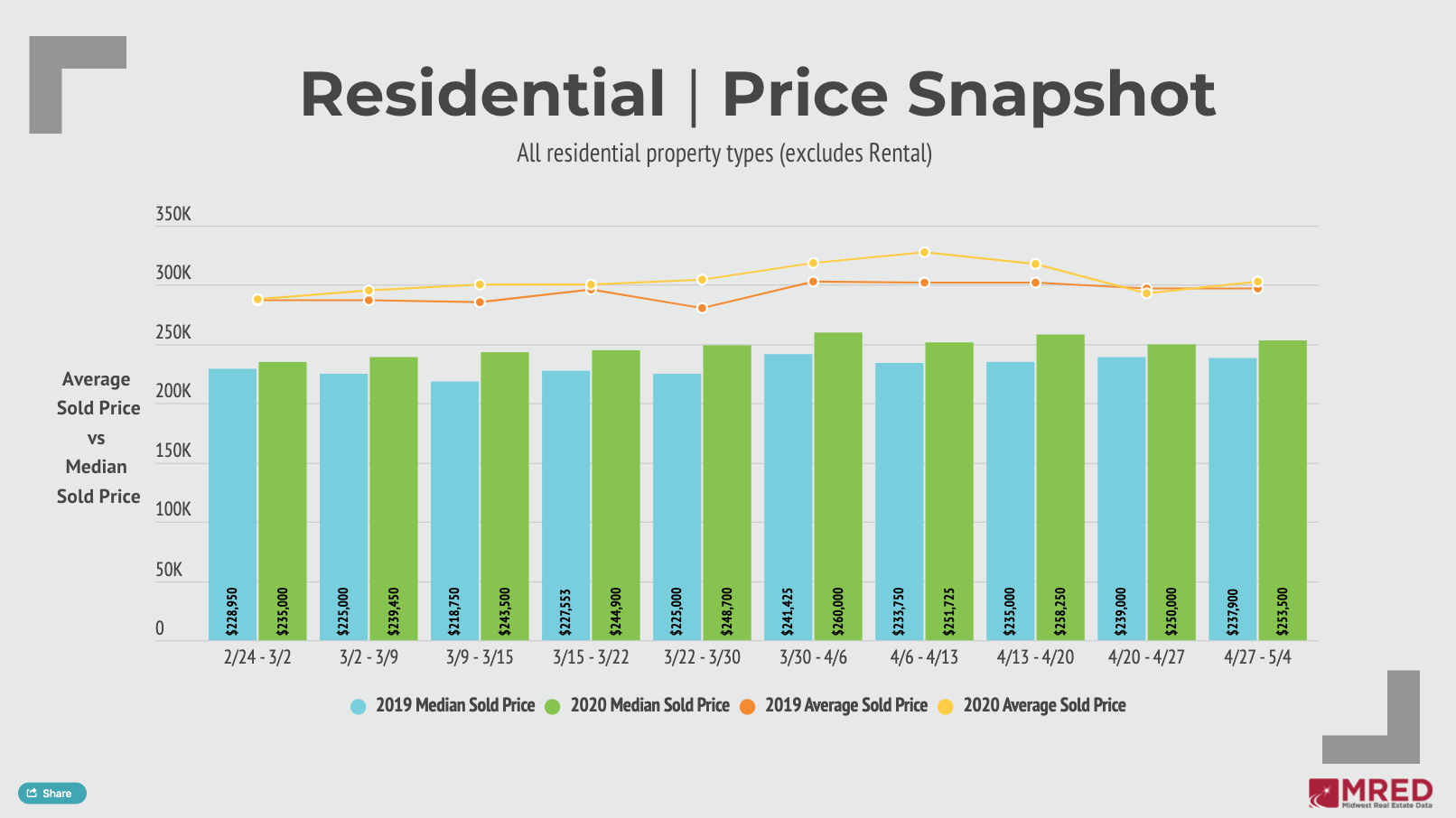

There is still good news in all of this: first off, our data shows that as of May 4, 2020, median sales prices are still higher than 2019, and haven't seen any huge shifts aside from a small dip 2 weeks ago (see charts below). Realistically, we may not see the full COVID-19 impact of prices until data from the next couple weeks rolls in (when properties that went under contract in the middle of the pandemic start to close). Even later, we might start seeing price shifts from corona after-effects down the line - there is a chance we may see some foreclosures after mortgage forbearance ends, if make-up payments aren't made.

(Data shows a significant drop in newly listed properties after corona hit. Before corona, we were beating 2019 numbers more each week. Now, it's halved, at best. The good news is, we're slowly and consistently moving back up.)

(Data shows a significant drop in newly listed properties after corona hit. Before corona, we were beating 2019 numbers more each week. Now, it's halved, at best. The good news is, we're slowly and consistently moving back up.)

(Average sales prices, as shown in the lines above the bars, show that we started 2020 with measurably higher prices than 2019. There's a clear plunge after corona hit, and for one week we're lower than 2019; but once we weathered the peak, it looks like the data is heading back up.)

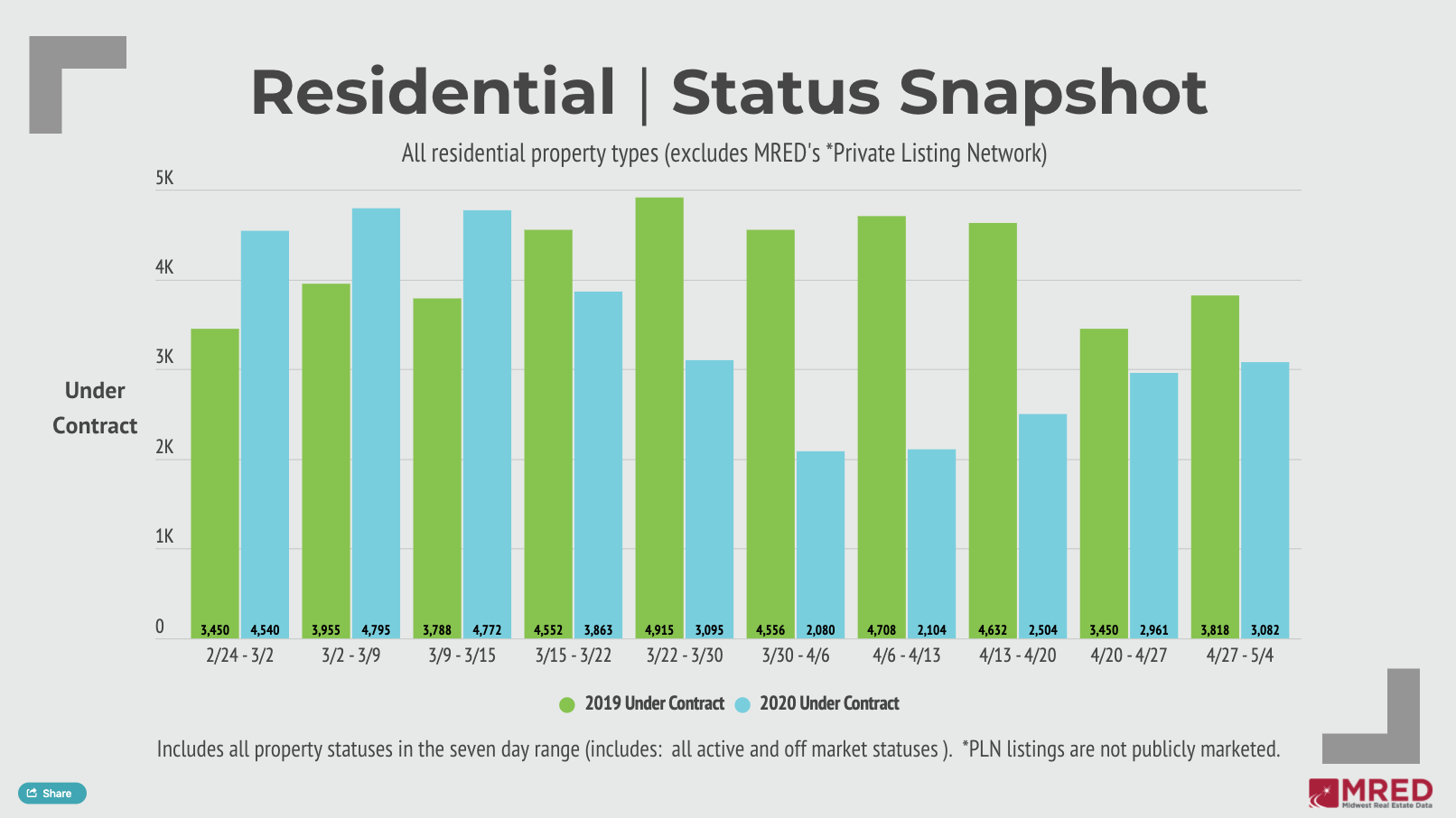

The most promising news in all of this is this: it looks like we're bouncing back. We're monitoring the data on a weekly basis, but since mid-April, listings, prices and under contract properties haven been consistenly going back up. Perhaps Chicagoland has settled into operating in this new normal, confidence is improving and life plans are starting to take on motion again - whatever the case, we're headed in the right direction (even with the continued, now stricter Illinois shutdown order).

(The number of listings that went under contract is going up at a similar rate to the amount of newly listed propertyes - meaning buyers and sellers are gaining confidence in harmony, and the market is beginning to move again).

To top it off with some more encouragement: the average rate for a 30-year mortgage hit 3.23% for the week ending April 30 - the lowest it's been since Freddie Mac began tracking rates in 1971! Compare that to last year, where the average rate was 4.14% at this time.

We haven't recovered yet, but so far, things are looking in the right direction.

If you need any advice on what you should do with your real estate questions, ask an arhome agent. We're here for you.

Author: Joanna Sokolowski

Sources realtor.com / MRED LLC

Leave A Comment