2021 Housing Market Outlook

2020 was the year of surprises. We saw an instant dip in the market when the virus news came to the US, only to turn around and witness one of the biggest booms in sales volume and prices in the last decade.

So what will 2021 hold? Are we headed for a crash, or will this keep going? Here's what experts are predicting.

Prices

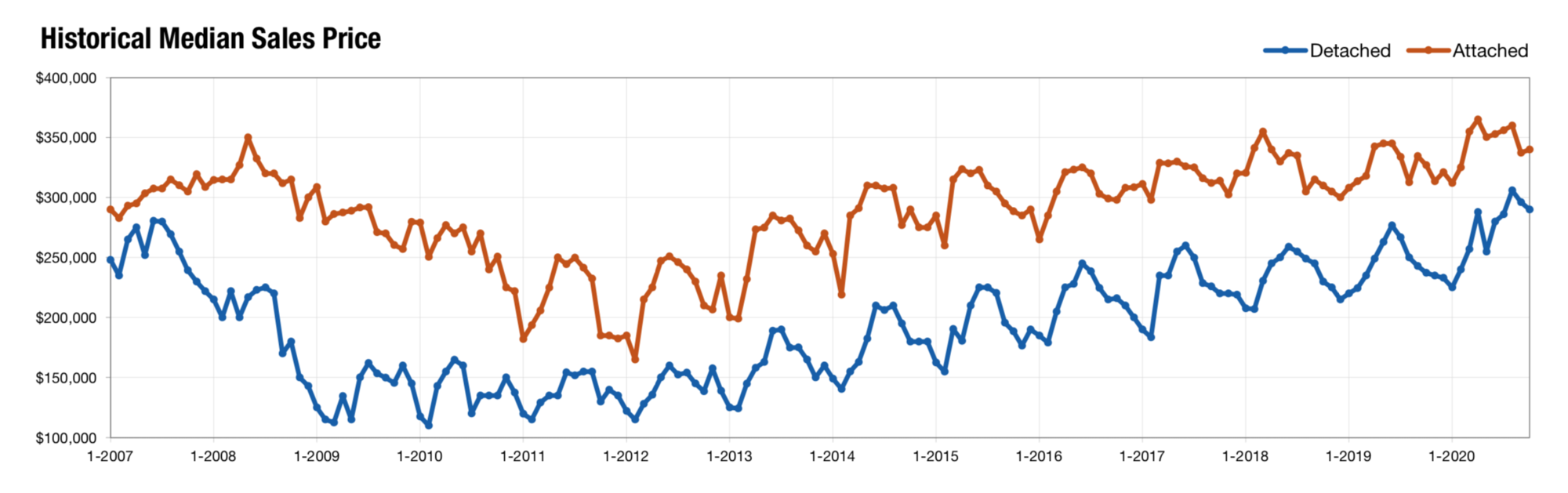

Despite the price bubble being the highest we've seen in over 10 years, most economist are predicting continued increases that head towards stability. Realtor.com chief economist Danielle Hale says prices will rise another 5.7% above 2020’s already high numbers. CoreLogic deputy chief economist Selma Hepp confirms the continued home price appreciation. There is general agreement that rising prices will create a barrier for the many first-time buyers which are expected to enter the market, especially when they have to rely entirely on cash savings for a down payment. All in all, the market is supposed to remain strong for sellers.

Historical home prices for Attached (condos) and Detached (single family) properties since 2007. Source: Chicago Association of REALTORS®

Number of Sales

According to Hale, a very strong buying demand will offset the predicted price growth. With a recovering economy, and currently still low rates, buyers will still have room to afford what they need. Hepp agrees: low interest rates will help with affordability concerns caused by the rapid home price growth in 2020. Robert Dietz, senior vice president and chief economist and National Association of Home Builders, affirms that that demographics, especially on first time buyer numbers, are so favorable that buyer traffic will remain strong despite rising prices. The bottom line: sales will still remain strong as low mortgage rates continue to increase purchasing power for the high wave of first-time home buyers we expect to see.

Location

With work from home and general uncertainty in the air, we have seen a trend of buyers moving out of city markets and in to suburban areas. National Association of Realtors chief economist Lawrence Yun believes this will continue. He predicts a stronger demand in the outlying suburbs, while downtown locations may see smaller demand. Dietz confirms, expecting a geographical shift in housing demand to lower-density markets.

The Bottom Line

Overall, the market is predicted to be stable and positive, with lots of new buyers and geographical shifts keeping housing demand strong. But with all the surprises brought in by 2020, we know these are only predictions; we are still closely monitoring the progress as it unfolds.

Written by Joanna Sokolowski

Source: Forbes.com; Chicago Association of REALTORS®

.png)

Leave A Comment